For decades, Cooperative Credit Societies have been the backbone of India’s rural and semi-urban financial ecosystem. Built on trust, mutual aid, and community relationships, cooperatives have always offered something large commercial banks struggle to replicate — a human connection.

But the competitive landscape has changed.

Today, cooperative societies are competing not just with nearby institutions, but with commercial banks, private lenders, and fintech startups offering fast, digital-first experiences. The competition is no longer limited to interest rates — it is now about digital convenience and accessibility.

So how can cooperative societies with limited resources compete with banks backed by massive technology budgets?

The answer lies in adopting a Next-Generation Core Banking Solution.

The Digital Divide: Why Members Are Switching

Today’s members are digital-first. Even in rural and semi-urban areas, users expect instant access to banking services through their smartphones.

Members now expect:

- Real-time balance updates

- Instant fund transfers

- SMS alerts for transactions

- Loan applications without repeated branch visits

When commercial banks offer mobile apps and 24×7 services while cooperative societies rely on manual, branch-centric processes, a digital divide is created. Over time, this leads to dissatisfaction and member attrition.

To remain relevant, societies must move from branch-only banking to anywhere, anytime banking powered by modern Core Banking Software.

What Makes a Next-Gen Core Banking Solution?

A traditional CBS records transactions.

A Next-Gen Core Banking Solution drives efficiency, transparency, and growth.

SmartCBS is a cloud-based, SaaS-driven platform designed specifically for Cooperative Credit Societies, NBFCs, and MFIs — not adapted from large commercial bank systems.

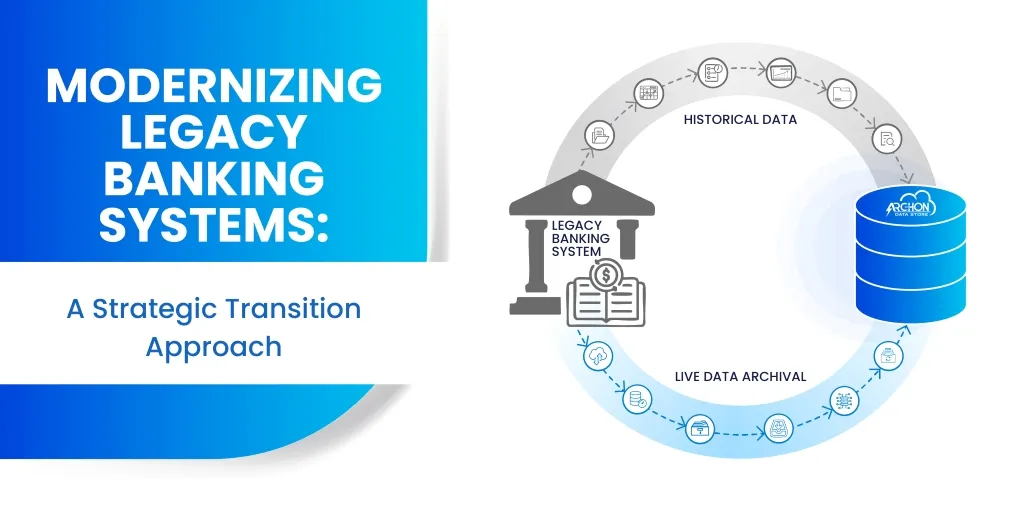

Legacy Systems vs Next-Gen CBS

| Capability | Legacy Systems | SmartCBS (Next-Gen) |

| Accessibility | Branch-only, on-premise | Cloud-based, 24×7 access |

| Mobile Banking | Often unavailable | Integrated mobile app & net banking |

| Loan Processing | Manual & slow | Automated straight-through processing |

| Security | Risk of local data loss | Bank-grade SSL & cloud encryption |

| Compliance | Manual reporting | Automated regulatory & audit reports |

With SmartCBS, institutions gain:

- Cloud-based, 24×7 system access

- Integrated mobile banking and net banking

- Automated loan workflows

- Secure, centralized data management

- Built-in compliance and reporting

This enables societies to operate with same efficiency as large banks, without losing their cooperative ethos.

How SmartCBS Helps Cooperative Societies Compete

1. Improved Member Convenience

With mobile banking and net banking, members can access their accounts anytime. This directly addresses the biggest reason for churn — inconvenience.

2. Faster Loan Processing

Digital documentation and automated workflows reduce loan approval time from weeks to hours, improving member satisfaction and operational efficiency.

3. Transparency and Trust

SmartCBS provides complete audit trails, maker-checker controls, and automated reconciliation — building confidence among members, auditors, and regulators.

4. Better Use of Staff Time

By eliminating manual paperwork, staff can focus on relationship-building, member support, and community engagement instead of data entry.

The Future of Cooperative Banking Is Digital

Adopting a modern Core Banking Solution is not about becoming a commercial bank. It is about protecting the cooperative model while operating with modern efficiency.

Institutions like Cyberabad Police Cooperative Credit Society demonstrate how digital transformation can improve transparency, convenience, and long-term sustainability.

As digital adoption accelerates, cooperative societies that embrace Core Banking Software will be better positioned to serve their members and grow responsibly.

Take the Digital Leap Today

Legacy systems should not limit your growth.

Discover how SmartCBS can enable NBFC digital transformation and modernize your Cooperative Credit Society Software with secure, scalable, and member-friendly banking technology.